The spread of COVID-19 and its associated impacts have again brought into focus the dependence of emerging market economies on external financing. This column analyses the factors that put emerging economies at an increased risk of a sudden reduction in dollar liquidity as a consequence of the COVID-19 outbreak. Based on this analysis, it reviews the key tools at the disposal of emerging economies, the Fed, and the IMF to address this problem. It concludes by offering some policy recommendations on the pecking order that could be followed to potentially shield the emerging economies from the dollar shortage problems related to COVID-19.

The spread of COVID-19 to emerging economies has brought to light a reality that had been mostly forgotten in an era of ample dollar liquidity, namely, their excessive dependence on external financing. This dependence, which had been a long-standing problem, as exemplified by the large number of crises experienced in the emerging world since the 1970s, seemed to have been overcome. COVID-19 has brought to light a very different reality. Foreign investors have left these markets at an unprecedented speed, rushing to the safety of dollar assets. This resulted in a sudden global dollar shortage last March. The massive capital outflows from emerging economies are not irrational. COVID-19 is having a massively negative impact on emerging economies’ growth prospects, exports and fiscal accounts (Baldwin and Mauro 2020).

Dependence on dollar liquidity

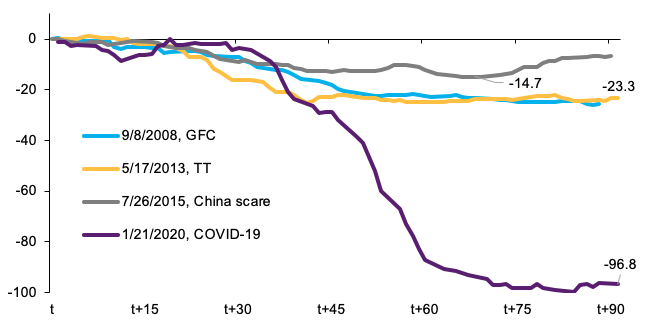

Emerging markets depend on foreign capital and income through a number of channels (Carstens and Shin 2019). The capital channel reflects the net borrowing through capital inflows. The more emerging markets rely on short-term portfolio inflows or ‘hot money’, the greater their exposure to global dollar liquidity shortages. The income channel consists mostly of the net exports of goods (including commodities) and services (notably tourism), or the payment for the cross-border use of a country’s endowment, which for emerging economies tends to be dominated by labour, thereby translating to considerable remittances. A shock like COVID-19 sharply reduces emerging markets’ access to dollars, exports, tourism receipts, and even remittances, likely even to a larger extent compared to advanced economies (Hevia and Neumeyer 2020). The sudden stop in portfolio flows into emerging economies has been unprecedented. In fact, the size of portfolio outflows is several times bigger than that of 2008, the 2013 Fed tantrum, or the China scare in 2015 (Figure 1). Against such backdrop, the IMF estimates that total gross financing need of emerging markets could be as much as $2.5 trillion. This is very much in line with the IMF having received requests for financial assistance from as many as 100 members already. A good part of these needs is concentrated in a few systemic emerging markets which have long maintained market access and are suffering the most from the sudden stop in capital inflows. This is especially worrisome in countries with larger external debt to serve.

Figure 1 Accumulated non-resident portfolio flows to emerging markets since indicated date ($ billion)

Source: IIF, Natixis

It is important to identify what are the tools that emerging markets can count on to address this challenge. We review the different options below and offer our recommendations as to the most urgent decisions that the countries affected, as well as the international community, should take to strengthen their access to external funding in the fastest way possible given the looming risk of financial crises in the emerging market space. It is important to point out that the focus here are liquidity problems, not solvency ones, but we do acknowledge that the line between the two will be blurrier than ever due to the massive economic impact of the pandemic. Furthermore, illiquidity left unaddressed for an extended period or in already borderline cases may push countries into a solvency crisis.

What to do?

The first and most obvious line of defence is to use a country’s own monetary policy to stimulate the economy. This is what central banks in the emerging world have been doing since the start of the pandemic, but the room for more easing seems to have been exhausted as emerging currencies have massively depreciated, increasing the value of their dollar debt without much benefit for exports in light of plummeting external demand. In other words, the space to continue to use monetary policy independently is capped by the investors’ willingness to accept currencies that have depreciated extensively and may not have reached the bottom.

The obvious short cut to avoid a vicious circle of rate hikes needed to stem off capital outflows is to introduce capital controls. The main argument in favor of capital controls is the increasingly deep financial integration of emerging economies with the rest of the world. The global financial cycle has transformed the well-known trilemma into a dilemma, whereby independent monetary policies are possible if and only if the capital account is managed directly or indirectly.1 There is, however, an undeniable cost associated with introducing capital controls, at least for those emerging economies with market access – namely, losing such access. No matter the degree of global dollar shortage we are already facing, Indonesia, UAE, and Qatar, among others, have recently tapped the market with strong investor interest. For countries which are still able to cover at least part of their financial needs in the market, opting for capital controls does not seem to be the right way to go.

Barring the use of strict capital controls, which could keep emerging economies cut off from international financing, other tools are needed to address the negative impact of COVID-19 on external funding. The two most obvious lines of defence which have been built over time are self-insurance through the accumulation of forex reserves and regional insurance schemes.

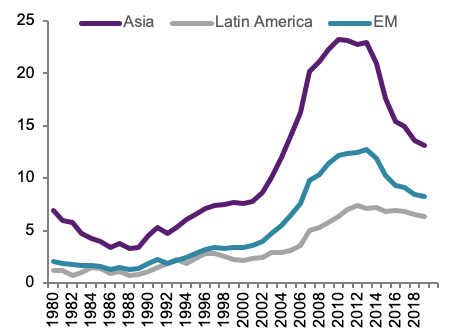

Only a few emerging economies can safely claim that their reserves are massive enough to deal with this shock. Most importantly, reserves tend to be concentrated in two main regions – Asia and the Middle East – with more than half of the some $22 trillion in forex reserves held by central banks and sovereign wealth funds globally. Low oil prices and commitments to production cuts mean that oil producers will have to draw down their forex reserves. As for Asia, the lack of external demand from the rest of the world should also reduce their current account balances, probably dragging down reserves, although quite likely with less intensity than in the Middle East. It should be noted that this process has already started in the Middle East since oil prices peaked in 2014, and even in Asia as current account surpluses have been shrinking since 2011, while the size of these economies has continued to grow relentlessly (Figure 2).

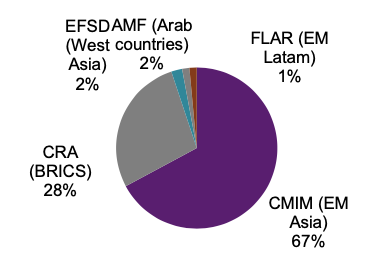

On regional insurance schemes, the heterogeneity among regions is also very large. The most developed scheme has been created in Asia under the aegis of the ASEAN+3, but is still subject to external conditionality, namely, that of the IMF (Rey 2013). The rest of emerging regions hardly count with any scheme of relevant size (Figure 3).

Figure 2 Foreign reserve (% GDP)

Sources: IMF, Natixis

Figure 3 Regional financing arrangement capacity in emerging economies (%)

Note: The RFAs are: Chiang Mai Multilateral Initiative (CMIM), BRICS Contingent Reserve Arrangement (CRA), Eurasian Fund of Stabilisation and Development (EFSD), Fondo Latinoamericano de Reservas (FLAR), Arab Monetary Fund (AMF)

Sources: IMF, Natixis

Leaving aside self- and regional insurance schemes, the role of the Fed as provider of cross-border liquidity deserves attention. After some hesitation, the 2008 global financial crisis opened the door for the Fed to offer limited but relevant support for central banks mostly in the developed world. This time around, the Fed has been faster in setting up swap lines and has even opened a repo facility for a large number of central banks. It should be noted, though, that this repo line is not targeted to any particular central bank and collateral is needed to borrow, which makes it a clearly inferior option compared to a swap line. We should, however, not expect the Fed to be the solution to emerging markets’ dollar problems as it is already massively expanding its balance sheet for domestic reasons and is expected to remain selective (Yeyati 2020).

The IMF is obviously the most appropriate institution to deal with the the liquidity problems that emerging countries are encountering due to the pandemic. The problem is that it lacks the lending capacity for such a surge in programme requests. There are currently three liquidity facilities provided by the IMF: two facilities that had existed in the past – the Flexible Credit Line (FCL) and Precautionary Liquidity Line (PLL) – and the Short-Term Liquidity Facility (SLL) that was introduced during April 2020 Spring Meetings. The Flexible Credit Line, set up in 2009, is unlimited in terms of size of access but is based on stringent pre-qualification criteria. The Precautionary Liquidity Line, introduced in 2011,2 has strong pre-qualification criteria as well as some ex-post conditionality and is rather limited in size.

Beyond the suitability of the IMF’s toolkit, which can clearly be improved beyond recent efforts, the key question, after all, is whether the Fund posseses enough financial resources to meet the pressing needs of its members. IMF available resources are currently estimated at just under $800 billion, as about one fifth of its total lending capacity of US$1 trillion is already committed with existing programmes.3 A cursory look at IMF resources can help us understand the difficulties to increase them. First, and foremost, quotas account for 65% of the total ($651 billion), the New Arrangements to Borrow (NAB) follow with $250 billion, which were doubled last January4 but still need consent from all creditors. Finally, the last component of resources are the Bilateral Arrangements to Borrow (BBs), which currently stand at $434 billion. Existing ones end this year, but new ones have been agreed this March up to 2023. While quotas may equal $651 billion, the ‘forward commitment capacity’ is around $285 billion. An overall quota increase for the IMF would be desirable to garner more resources and improve composition of financing – a large share of the IMF’s funding will come from a pool not requiring additional rolling approvals. Ultimately, a quota increase will be needed, which would in turn require addressal of the voting power issues. This is, however, not a quick solution.

Conclusions

COVID-19 is by far the biggest challenge that policymakers in emerging economies have had to deal with in recent history. Most specficially, the worsening of their external funding conditions will be a major issue for most countries. The first line of defence – namely, using a country’s monetary policy room to support growth – is becoming ineffective as investors shy away from weak currencies. Capital controls could provide a temporary relief but are costly as they would imply losing access to foreign funding altogether. Self-insurance and regional insurance schemes are an option for a select few, especially in Asia, but the duration and depth of the shock is uncertain, which justifies exploring other potential options. The Fed has been quite fast in providing cross-border dollar liquidity, but it risks been overburdened due to massive domestic needs. Finally, the IMF continues to be the most obvious – albeit constrained – lender of last resort. Two changes are urgently needed for the Fund to be more effective:. The first is a more targeted set of liquidity facilities with quicker disbursement and less conditionality. Second, further recapitalisation is a must, but the options being discussed, including a new SDR allocation or a quota reform, will take time. Meanwhile, the recently approved NAB needs to result in actual disbursement by creditors and a rethinking of the timeline for BBs into a much more imminent one is also urgent.

Authors’ note: The views and opinions expressed in this column are those of the authors and do not necessarily reflect the official policy or position of the Institute of International Finance, or any other organization, employer or company. Assumptions made in the analysis are not reflective of the position of any entity other than the authors. We thank Suman Bery, Marek Dabrowski, Maria Demertzis, Piroska Nagy Mohacsi, Alexander Lehmann, Franceso Papadia, Mark Sobel, Brad Setser, Nicolas Veron and Guntram Wolff for useful comments. Remaining errors are all ours. A longer version of this paper is forthcoming as a Bruegel policy note (www.bruegel.org).

Alicia García Herrero is a member of the GLOBE Advisory Board and a Senior Fellow at European think-tank BRUEGEL.

Elina Ribakova is Deputy Chief Economist at the Institute of International Finance (IIF).

Article published in "VoxEU.org – CEPR’s policy portal" on May 21, 2020

References

Baldwin, R and B W Mauro (2020), Economics in the time of COVID-19, a VoxEU ebook, London: CEPR Press.

Carstens, A and H S Shin (2019), “Emerging markets aren't out of the woods yet”, BIS.org, 22 March.

Hevia, C and P A Neumeyer (2020) “A perfect storm: COVID-19 in emerging economies”, VoxEU.org, 21 April.

Rey, H (2013), “Dilemma not Trilemma: The global financial cycle and monetary policy”, VoxEU.org, 31 August.

Yeyati, E L (2020) “COVID, Fed swaps and the IMF as lender of last resort”, VoxEU.org, 31 March.

Endnotes

2 https://www.imf.org/en/News/Articles/2015/09/14/01/49/pr11424

3 https://www.imf.org/external/np/tre/activity/2020/041720.pdf